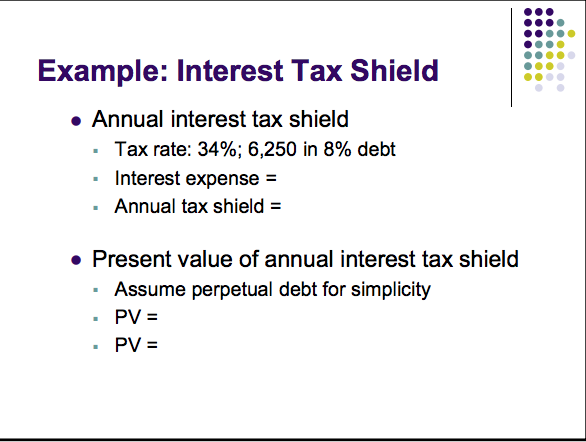

interest tax shield example

Tax_shield Interest Expense Tax_rate 20000 35 7000. Interest Expense 20000.

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

The tax savings for the company is the amount of interest multiplied by the tax rate.

. Tax shields are favored by wealthy individuals and corporations but middle-class individuals can benefit from tax shields as well. If the tax rate is 10 then the tax liability will be 4000. For both companies well be using the following operating assumptions.

The principle behind these instruments is to maximize a companys earnings and minimize its costs. For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income. Obviously a company makes money from interest income related to investments.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Tax rate 35. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Interest Tax Shield Calculation Example. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows before taxation work out to USD 8 million.

Assuming Company A also has an interest obligation of 5000 the total taxable income will be 35000 40000 5000. Increase in firm value due to borrowing. This is the same as multiplying the interest.

Now the tax liability will be 3500. Assume Case B brings after-tax income of 144 per year forever. The value of tax shields depends on the following.

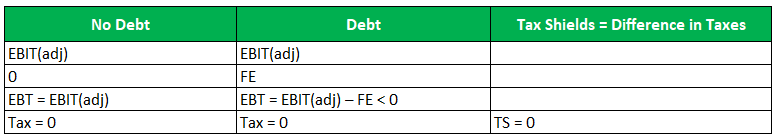

This is best illustrated with a simplistic example. But that interest counts as income on a companys books so would not lead to tax deductions. Such a deductibility in tax is known as interest tax shield.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. Examples of tax shields include deductions for charitable contributions mortgage deductions medical expenses and depreciation. The interest expense associated with the mortgage is tax deductible which is then offset against the taxable income of the person resulting.

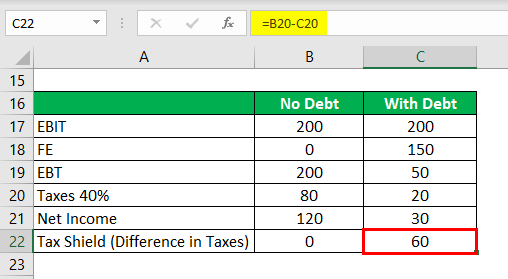

Calculating the Value of a Tax Shield. In this exercise well be comparing the net income of a company with vs without interest expense payments. 1800 1000 800.

For example For a company with a 15 loan of 200000 and a tax rate as 25 the tax shield approach will be 15 x 200000 x 25 7500. A tax shield refers to deductions taxpayers can take to lower their taxable income. As is hopefully clear by this stage the interest tax shield is just one example of the tax shielding opportunities available to companies.

For example Company ABC has a 10 loan of 200000 and the applicable tax rate is 20. The following are the main differences between interest tax shelters and debt. This is also termed as an interest tax shield approach which will be studied in brief later.

The tax shield in this case will be 4000 10 200000 20. What is the interest tax shield provide a numerical example. The amount of the deduction.

Interest tax shields are a type of capital gain that can be used to finance investment projects. The tax savings are calculated as the amount of interest multiplied by the tax rate. For instance Suppose Company A has earned a profit before interest and tax of 40000 for a year.

This is equivalent to the 800000 interest expense multiplied by 35. If we add financial expenses that what will be the final outcome. Using the above examples.

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. Example of an Interest Tax Shield The amount of tax savings realized by this corporation is equal to the interest payment multiplied by the tax rate. For example if you expect interest on a mortgage to be 1200 for the year and your tax rate is 20 the amount of the tax shield would be 240.

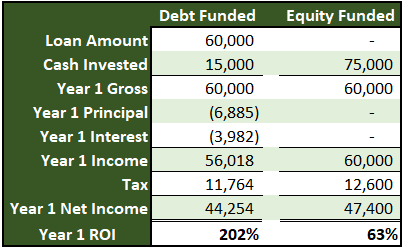

Interest bearing debt x tax rate. The classic example of a tax shield strategy for an individual is to acquire a home with a mortgage. A leverage of 20 means that 20 of.

Under this assumption the value of the tax shield is. Cost of Goods Sold COGS 10m. These investments are based on the concept of leverage.

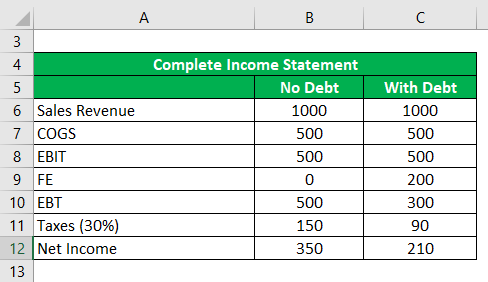

You can download this Tax Shield Formula Excel Template here Tax Shield Formula Excel Template Tax Shield Formula Example 1 Assume a firm with a Sales revenue of 1000 a Cost of goods sold COGS of 500 a Financial Expenses FE of 200 and a corporate tax rate of 30. As a result the shield is equal to 8000000 divided by 10 divided by 35 is 280000. Operating Expense OpEx 5m.

Depending on the current tax regulations that apply all or a portion. We also call this Interest tax shield. The effective tax rate of the business.

Value of firm after-tax income return of capital therefore. Assume Case A brings after-tax income of 80 per year forever. When a corporate carries Debt it is considered leveraged.

This reduces the tax it needs to pay by 280000. One of the easiest ways to understand how an interest tax shield functions is to consider an individual who currently holds debt in the form of a mortgageIn many nations it is possible to claim a tax deduction based on the amount of interest that is paid to the lender over the course of the tax year. As such the shield is 8000000 x 10 x 35 280000.

Tax Shield Formula How To Calculate Tax Shield With Example

How Tax Shields Work For Small Businesses In 2022

Chapter 15 Debt And Taxes Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Excel Calculator

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

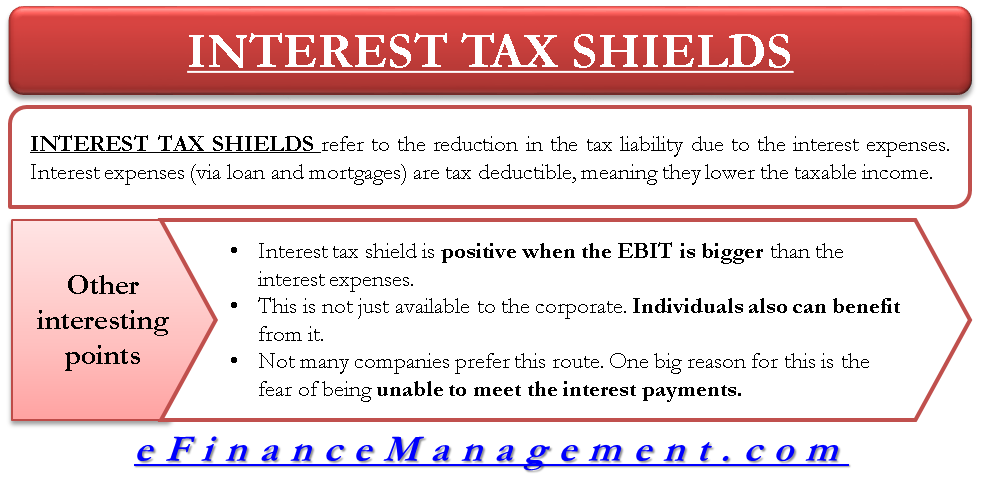

Interest Tax Shields Meaning Importance And More

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

The Interest Tax Shield Explained On One Page Marco Houweling